tax act stimulus check error

The Recovery Rebate Credit was added for 2020 as part of the CARES Act to reconcile your Economic Impact stimulus payment on your 2020 tax return. I was told because we chose to pay our tax preparation fee out of our 2019 refund the stimulus was deposited into their HR Block bank account instead of mine Cherish.

Stimulus Checks Tax Returns 2021

These updated FAQs were released to the public in Fact Sheet 2022-27 PDF April 13 2022.

. Since both stimulus payments were sent out before the 2020 tax return was. That said there are some steps you can take to be proactive. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and.

If you didnt get the full amount of the third Economic Impact Payment you may be. Enter and verify bank account information complete all steps. Of note the IRS is also using information from this seasons returns to process the new 1400 stimulus checks or potentially top up those payments.

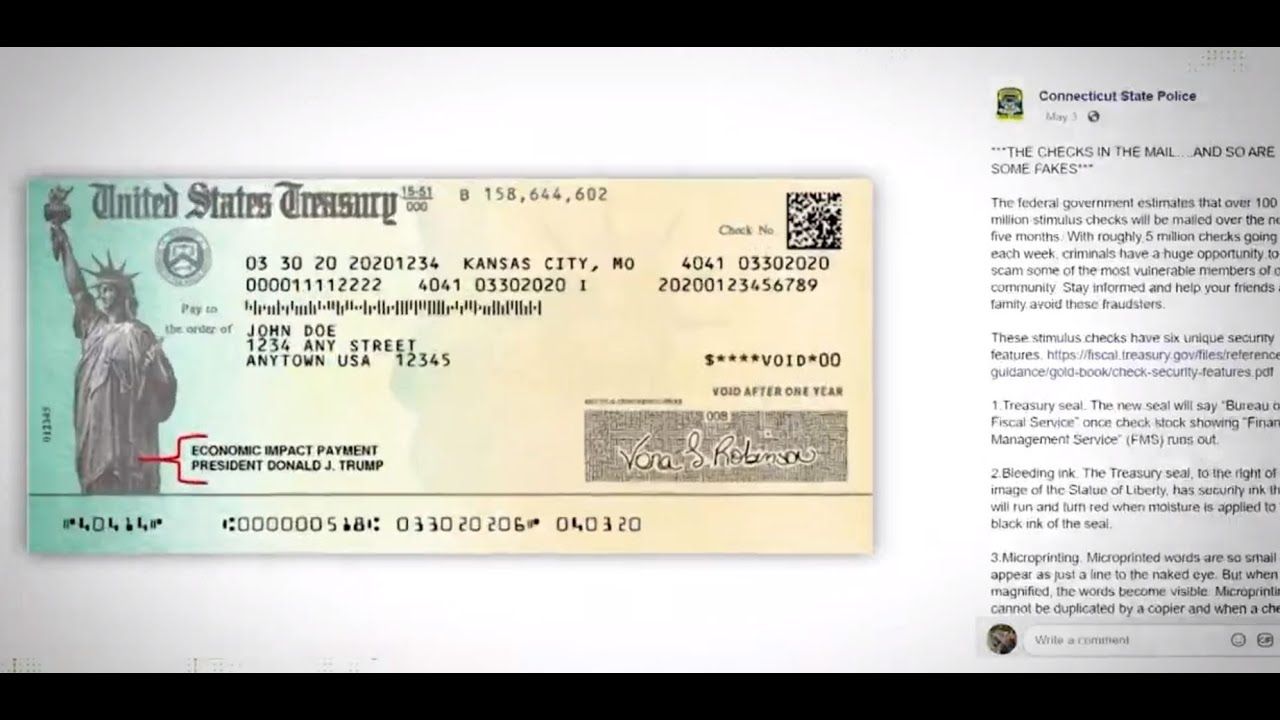

Write void in the endorsement section on the back of the check. The stimulus payments are an advance on a tax credit specifically designated for the 2020 tax year. If you are unable to resolve your issues with the IRS and are eligible for direct assistance generally you are one of the taxpayers identified in 1-7 above and you meet TAS.

The important details you want to know. Transcript says 14 and the check my payment or whatever its called shows status not available. IRS was at half.

This year individual tax. But the IRS states. This modal can be closed by pressing the Escape key or activating the close button.

Write a note to include with the check explaining why it is being returned. First double-check that you qualify for a stimulus check. Mail the check and the note to the.

We filed with Tax Act and had our fees taken out of our return. The IRS and tax industry partners are taking immediate steps to redirect stimulus payments to the correct account for those affected the IRS said in a statement adding. Your Online Account.

Go to Wages Income at the top of the screen. Currently the second stimulus. Transcript says 14 and the check my payment or whatever its called shows status not.

Go to Federal on the left side of the screen. It told me my tax refund and the 3rd stimulus of 1400. A number of stimulus checks still have to go out.

Click Add Form 1099-INT. Scroll to the bottom of the section without making any changes and click Wrap Up. People who do not receive their stimulus payment by the January 15 deadline will have to wait to claim their stimulus check as a tax credit when they file their 2020 taxes.

We use chase for our bank. TurboTax and HR Block customers are reportedly struggling to get their stimulus. In a statement tax service Jackson Hewitt said Were happy to confirm that the IRS will start processing stimulus payments when their systems come back online and.

There has been a flood of math error notices from the IRS in 2021 with 9 million sent through July 15 and 74 million were due to stimulus payments according to Taxpayer Advocate Service. Using the total amount of the third payments from the individuals online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the. If you make a mistake on the Line 30 amount the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to your tax.

Enter 1 in Box 1 Interest income. Hell have to wait to pick up the rest of the EIP on the 2020 return. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the.

The second round of stimulus payments are based on the information reported on your 2019 tax return. We filed with Tax Act and had our fees taken out of our return.

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Second Coronavirus Relief Package What Does It Mean For You And A Second Stimulus Check The Turbotax Blog

Missing Or Shortchanged Stimulus Check Here S What To Do Kiro 7 News Seattle

Stimulus Check Problems Result In Irs Sending Money To Dead People Wrong Accounts During Coronavirus Pandemic Abc11 Raleigh Durham

Third Stimulus Check Update How To Track 1 400 Payment Status Abc10 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Is Your Stimulus Check Missing Or Inaccurate Here S What To Do

Second Stimulus Check Update Stimulus Package News Thursday August 6 Youtube Stock Market For Beginners Investing Stocks For Beginners

![]()

1 400 Stimulus Check Tracking What Error Messages Payment Status Not Available Means

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc11 Raleigh Durham

Four Reasons Why You May Have To Repay The Irs Due To Stimulus Check Mistakes

Americans Struggle To Receive Missing Stimulus Checks

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Irs Sent Second Stimulus Payments To Wrong Bank Accounts The Washington Post

The Irs Stopped Accepting Direct Deposit Requests On May 13 That Doesn T Mean You Won T Get A Check However Irs Filing Taxes Deposit

Verify How To Make Sure Your Stimulus Check Is Real Youtube

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco